Everyone should see the 6-minute video below, and then send it on to friends and family. It is fantastic, well-made, and, after you see it, unforgettable:

-

Join 854 other subscribers

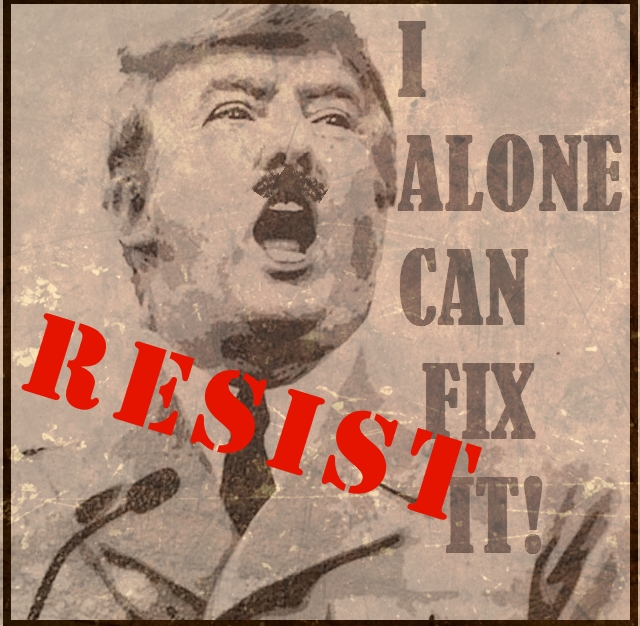

No, He’s Not Hitler—Yet. Trumpism is not Fascism—Yet. And while 63 MILLION AMERICANS voted for this guy, that is only 27 Percent of the voting-eligible population. There is plenty of resistance out there to make sure he doesn’t become Hitler and we don’t succumb to neo-fascism. Let’s get to work.

How to help save our national integrity

Search This Blog

Recent Comments

-

Recent Posts

- “What’s Really Radical? Not Taxing the Rich,” By David Leonhardt

- “Why are we so angry?” Here’s Why.

- Some Things, And Some People, Deserve Our Contempt

- More Ugly

- Ugly

- In Case You Don’t Subscribe To The New York Times, Here Is Why You Should

- A Periodic Note Of Hope

- Kavanaugh Is A Liar. Period.

- Remarks And Asides, 9/25/18

- Help This Guy. He’s Good People. And Help Dems Take The House.

- The C Word

- What Roe V. Wade Is All About

- My First Prayer For Tr-mp, Long Overdue

- Two Kinds Of Resistance

- Enough.

-

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 3.0 United States License. HELP NEEDED:

News Sans Conservative Bias

News Sans Conservative Bias- An error has occurred; the feed is probably down. Try again later.

Science News

Science News- Stunning Comet Could Photobomb This April's Total Solar Eclipse

- The Industrial Designer behind the N95 Mask

- An Evolutionary 'Big Bang' Explains Why Snakes Come in So Many Strange Varieties

- JWST Is Tracking Down the Cosmic Origins of Earth's Water

- Flimsy Antiabortion Studies Cited in Case to Ban Mifepristone Are Retracted

- First Commercial Moon Landing Returns U.S. to Lunar Surface

- JWST Solves Decades-Old Mystery of Nearby Supernova

- Why Do We Have a Leap Year Anyway?

- Why Writing by Hand Is Better for Memory and Learning

- People with Myalgic Encephalomyelitis/Chronic Fatigue Syndrome May Have an "Exhausted" Immune System

Raison d’être

CLICK BELOW TO HELP UNION TROOPS IN THE CLASS WAR:

LINKS

NYT > Dow Jones Stock Average

NYT > Dow Jones Stock Average- Trump or Biden? The Stock Market Doesn’t Care.

- Investors Pour Money Into Wall St. as Stocks Set New Highs

- Wall St. Pessimists Are Getting Used to Being Wrong

- Stock Market Slips as Traders Move Cautiously Ahead of Fed Meeting

- The Fed Won’t Say It, but It Doesn’t Want a Strong Stock Market

- S&P 500 Hits Lowest Level of 2022 as Global Sell-off Continues

- What Is a Bear Market?

- Why Midterm Election Years Are Tough for the Stock Market

- La crisis de Rusia y Ucrania está sacudiendo los mercados y las carteras de valores

- How the Russia-Ukraine Crisis Is Shaking Markets and Portfolios

NPR Topics: Business

NPR Topics: Business- Inside the epic fight over new banking regulations

- Trump Media shares surge after a miserable run. Pros say stay away

- It's been an up and down week for Trump's DJT stock

- Google fires 28 workers who protested selling technology to Israel

- Trader Joe's recalls basil linked to 12 salmonella infections in 7 states

- 'Sesame Street' writers authorize a strike if they don't reach a contract by Friday

- Housing costs keep inflation stubborn; New report on Maui wildfires released

- Experts: Boeing's safety culture is broken and defective airplanes are being put out

- Morning news brief

- A big event is about to happen in the world of bitcoin: It's called the halving

NPR Topics: World

NPR Topics: World- Hindu nationalist music could be destructive ahead of Indian elections, critics warn

- This week in science: Pompeiian frescoes, dark energy and the largest marine reptile

- Biden reinstates sanctions on Venezuela

- Ukraine's prime minister on how U.S. aid could make a difference on the frontlines

- Speaker Johnson moves forward with foreign aid package, even if it risks his job

- What to know about the U.N. vote on whether to admit Palestinians as full members

- Is a Popular Music Genre in India Spreading Hate?

- One man's search for his father in mass graves at Gaza's Al Shifa hospital

- Gaza cease-fire resolutions roil U.S. local communities

- Lethal heat in West Africa is driven by human-caused climate change

Philosophy Bites

Philosophy Bites- An error has occurred; the feed is probably down. Try again later.

NPR Topics: Culture

NPR Topics: Culture- Amateur art detectives used modern tools and the law to return stolen artifacts

- Salman Rushdie tells of the violent attack that nearly killed him in memoir 'Knife'

- What makes a good courtroom drama

- Journalist says we're 'basically guinea pigs' for a new form of industrialized food

- 'When I Think of You' could be a ripped-from-the-headlines Hollywood romance

- 'The Beast' jumps from 1910, to 2014, to 2044, tracking fear through the ages

- 'Sesame Street' writers authorize a strike if they don't reach a contract by Friday

- 'Conan O'Brien Must Go' is side-splitting evidence of life beyond late night TV

- How 'Hot Ones' took wing(s)

- What happened when the threat of danger became Salman Rushdie's reality?

NPR Topics: Opinion

NPR Topics: Opinion- The relentless focus on Gaza

- Opinion: Open Wall nights could lead to the next artistic visionary

- Opinion: Air Force One and the great pillowcase plunder

- Opinion: Russian Jehovah's Witnesses remain devout despite facing bans

- Opinion: For one Ohio candidate, it was over before it was over

- My patients think Ozempic is a wonder drug. But it can't fix fat phobia

- Opinion: Animals have overtaken our lives, and we're having a wonderful time

- Wrestling with my husband's fear of getting COVID again

- Opinion: Some heroes drive city buses

- Award shows have become outrage generators. Surely there's another way?

NPR Topics: Economy

NPR Topics: Economy- Inside the epic fight over new banking regulations

- It's been an up and down week for Trump's DJT stock

- Housing costs keep inflation stubborn; New report on Maui wildfires released

- Inflation is more stubborn than expected this year. One reason is rising rents

- Many baby boomers own homes that are too big. Can they be enticed to sell them?

- Grocery prices, credit card debt, and your 401K (Two Indicators)

- Profiting off greater risk: the reinsurance game

- Despite global instability, IMF says world economy show 'remarkable resilience'

- The IRS commissioner faced tough questions from Senate Finance Committee

- What is a 'freedom economy'?

NPR Topics: Law

NPR Topics: Law- Trump's anti-abortion stance helped him win in 2016. Will it hurt him in 2024?

- Maine lawmakers pass sweeping gun legislation following the Lewiston mass shooting

- The Supreme Court opens the door to more discrimination claims involving job transfers

- Supreme Court gives skeptical eye to key statute used to prosecute Jan. 6 rioters

- In Arizona, political candidates walk a fine line on abortion rights

- Supreme Court hears challenge to a statute used to try hundreds of Jan. 6 rioters

- A former Marine gets 9 years for firebombing a California Planned Parenthood clinic

- Morning news brief

- Supreme Court hears challenge to law used to prosecute hundreds of Jan. 6 defendants

- Supreme Court temporarily revives Idaho law banning gender affirming care for minors

NPR Topics: Religion

NPR Topics: Religion- Hindu nationalist music could be destructive ahead of Indian elections, critics warn

- Trump's anti-abortion stance helped him win in 2016. Will it hurt him in 2024?

- Columbia president tells lawmakers at antisemitism hearing there is a 'moral crisis'

- What happened when the threat of danger became Salman Rushdie's reality?

- Why London's Muslim mayor needs the same security as the king

- Decades old land-sharing deal on a holy site between Hindus and Muslims unravels

- A church offers asylum seekers a loan

- Florida voters will decide on abortion rights this fall. Here's what some are saying

- 6 in 10 U.S. Catholics are in favor of abortion rights, Pew Research report finds

- Palestinians forgo Eid celebrations to mourn for Gaza

Covers.com: general News and Stories

Covers.com: general News and Stories- NFL Draft Odds 2024: Caleb Williams Destined for Chicago

- Toronto Maple Leafs vs Boston Bruins NHL Playoffs Series Odds, Picks & Preview

- How Fanatics-Owned PointsBet Surged Ahead of DraftKings in New Jersey During March

- NFL Reinstates Five Players Suspended for Sports Betting: Reports

- Kings vs Pelicans Predictions, Picks, Odds for Friday's NBA Playoff Game

- Former DraftKings Executive Denies Breach Claims Before Fanatics Departure

- Copa America Odds 2024:Argentina's Odds Shortening Despite Two Months Until Kick-Off

- Diamondbacks vs Giants Prediction, Picks, and Odds for Tonight’s MLB Game

- Euro 2024 Odds: England Slight Favorites Ahead of France

- 2023-24 EPL Title Odds: Down to the Wire

Covers.com: general News and Stories

Covers.com: general News and Stories- NFL Draft Odds 2024: Caleb Williams Destined for Chicago

- Toronto Maple Leafs vs Boston Bruins NHL Playoffs Series Odds, Picks & Preview

- How Fanatics-Owned PointsBet Surged Ahead of DraftKings in New Jersey During March

- NFL Reinstates Five Players Suspended for Sports Betting: Reports

- Kings vs Pelicans Predictions, Picks, Odds for Friday's NBA Playoff Game

- Former DraftKings Executive Denies Breach Claims Before Fanatics Departure

- Copa America Odds 2024:Argentina's Odds Shortening Despite Two Months Until Kick-Off

- Diamondbacks vs Giants Prediction, Picks, and Odds for Tonight’s MLB Game

- Euro 2024 Odds: England Slight Favorites Ahead of France

- 2023-24 EPL Title Odds: Down to the Wire

Archives

- February 2019

- October 2018

- September 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- May 2009

- April 2009

- March 2009

- February 2009

BRING IN THE CLOUDS

abortion Affordable Care Act Ayn Rand Bain Capital Barack Obama Benghazi Bernie Sanders Bill Clinton Bill O'Reilly Billy Long Bush tax cuts Chris Christie Claire McCaskill debt debt ceiling deficit Donald Trump Elizabeth Warren Eric Cantor fox news George W. Bush George Will glenn beck government shutdown Harry Reid Hillary Clinton Israel Jack Abramoff Jim DeMint Joe Scarborough John Boehner John McCain Joplin Joplin Globe Joplin tornado Karl Rove Lawrence O'Donnell Medicaid Medicare Michele Bachmann Missouri Mitch McConnell Mitt Romney Morning Joe MSNBC national debt Newt Gingrich NRA Obama Obamacare Osama bin Laden Ozark Billy Pat Buchanan Pat Robertson Paul Krugman Paul Ryan President Obama Rachel Maddow Rand Paul Republican Republican Party Rick Perry Rick Santorum Ronald Reagan Ron Richard Roy Blunt rush limbaugh Sarah Palin sean hannity Social Security Supreme Court Tea Party Todd Akin tr-mp Trump

Stealth Wealth

by R. Duane Graham on March 5, 2013

• Permalink

Posted in Uncategorized

Posted by R. Duane Graham on March 5, 2013

https://duanegraham.wordpress.com/2013/03/05/stealth-wealth/

Previous Post

Fixing The National Debt, One Meal At A Time

Fixing The National Debt, One Meal At A Time

Troy

/ March 6, 2013BRAVO!!!!

LikeLike

ansonburlingame

/ March 6, 2013Duane,

Anyone that pays attention to macro economics knows the shape of such graphs today in America, sort of. But…….

I wonder if that graph takes into account the “wealth” of those far to the left gained from current entitlements alone, local, state and federal entitlements. A “man” earning say $10,000 a year thru “working” receives many “benefits” to agument such low income. Is that “wealth from entitlements” included in the graph and as well is the top 10% of “wealth” before or after taxes on an annual basis as well? I don’t know, but sure do “suspect” such skewed numbers on a politically motivated graph.

Actually, I wish I knew more about this subject of income distribution in America. As you know I put forth the effort to study, in a college course, macro economics for a semester. Not ONCE was income distribution included in that course of instruction including what it really is and what effects government programs might or might not have on it.

I raised that issue with the President of MSSU, the Dean of the Business school and my own professor and all agree more should be said in such a course. But for now, I have no academic or intellectual basis to even begin to understand WHY that graph as presented is the way it is or even more important WHAT should be done about it, by government, etc.

I do know this from history however. In 1788 ALL taxation to support the French government, the monarchy and its armies, came from ONLY the Third Estate, the common people. The nobility and clergy paid ZERO taxes for the country.

Today the American clergy STILL pays zero in taxes (by clergy I mean churches, not individual ministers, etc.) but the “nobility” in America pay 75% of all the federal income taxes and the bottom 50% pay zero income taxes, the principle source of money for the federal government. But of course you have heard that before for today in America but may not know the history in France in 1788, just before the Revolution when heads started to roll.

If liberals could somehow gain the upper hand and get the top 10% to pay 90% or even 100% of federal income taxes, I wonder how the shape of the above curve would change. My guess is not by very much as the money would “fly” out of the country.

When that began to happen (actually it already IS happening) then laws could be passed to outlaw the flight of such money, out of the country. Next step, PEOPLE, rich people, will get on airplanes and do their own flying, out of the country. And as Reich suggests we can replace them with immigrants, who will be in the bottom 50% and STILL pay no federal income taxes as well. Then what?

Bottom line Duane, I am unaware of any effective manner for government to do much at all about the curve you post nor do I accept the full “truth” behind that curve. I simply don’t know enough about the whole issue of income distribution, anywhere, to understand an effective manner to control it. Historically however, I have read of some real disasters that have happened around the world throughout history when governments step in with too much force as well.

As only an example, Hitler claimed the Jews had too much money in post WWI Germany and look what happened. And by and large the German people went right along with him, for a while. Then we could move east to Russia or farther east to China and watch how income distribution was handled therein as well, for a while.

Anson

LikeLike

ansonburlingame

/ March 6, 2013I appologize, in advance, for the length of the above and this “extra” reply. But I do have another real question, a fundamental one.

The video claims $54 Trillion last year in American wealth. But our traditional manner in deciding financial issues within America is GDP which is only about $15 Trillion (plus or minus a little)

We current spend, by the federal government, some 25% of GDP but obviously it is only about (3.5/54) 6.4% of total wealth. Seems like we could spend a helluva lot more by the federal government if only it could tax that total wealth, right??

Care to discuss the politics of doing THAT?

Anson

LikeLike

R. Duane Graham

/ March 6, 2013The total net worth for U.S. households was around $65 trillion at the end of the third quarter of 2012 (as far as I could find). The current numbers for 2012 GDP are just less than $16 trillion.

As far as federal spending as a % of GDP, it was just below 23% in 2012, not 25%. For 2013, spending is around $3.8 trillion, which is about 5.9% of total wealth. So, if we wanted to get our priorities straight, we would, yes, find a way to tax more of the total wealth in this country. But, of course, the politics, at least right now with the Tea Party disproportionately taking up seats in Congress, won’t permit such a thing to happen. Just more deficits, that’s all.

Duane

LikeLike

Jane Reaction

/ March 6, 2013Excellent, accurate graphic. Isn’t it frightening how little Americans know? For example, the commenter tried to compare GDP, which is measured by current production, to total wealth. Not only are they different animals, but for the majority of Americans GDP growth is what keeps us going, since the wealthy have already looted our assets, as can be easily seen.

LikeLike

henrygmorgan

/ March 6, 2013Anson:

First, the President of MSSU is, like me, an English major. I’m not surprised that he had no answers for you. But to the point, I am amazed at the numerous statements of ignorance of the subject you express in your post: “Actually, I wish I knew more about the subject of income distribution in America.” “But for now I have no academic or intellectual basis to even understand WHY that graph as presented is the way it is or even WHAT should be done about it, by government, etc.” “I simply don’t know enough about the whole issue of income distribution, anywhere, to understand an effective manner to control.”

With all due respect, and I do mean that, I would think that you would have a good deal more reluctance to comment on a topic about which you admit you have so little knowledge. I mentioned to you in an earlier discussion that there is no one absolute theory of economics, that economists disagree on economic theory, a fact represented by the differences in the. political theories of Milton Friedman and Paul Krugman, even though both are highly respected Nobel Prize winners. Listening to the recent Joe Scarborough – Paul Krugman debate on Charlie Rose is a very good example. Just my opinion.

Henry

LikeLike

R. Duane Graham

/ March 7, 2013Henry,

That Scarborough-Krugman debate could have been so educational, except Scarborough wasn’t interested in anything but degrading Krugman, and Krugman, being by temperament an academic, doesn’t really know how to mud wrestle on that level. I suggest Krugman watch a little more Morning Joe and see how Joe operates (bullying,interrupting etc.) and then ask for a rematch.

Duane

LikeLike

brucetheeconomist

/ March 6, 2013Is there any more detail on these graphic were derived? In general I think wealth is pretty concentrated, but I suspect this might wealth measured as value of equities held, bonds, cash, near cash assets and other financial wealth. I think if you add in the value of homes, small business (I know this is a conservative cliche), antos, and other non-financial wealth I think the distribution would look flatter. It would still be pretty skewed though.

Honestly, I can live with the rich being rich and getting richer. The middle and lower class being flatlined or losing not just relatively, but absolutely is the much bigger concern and unacceptable.

LikeLike

R. Duane Graham

/ March 7, 2013I have none of the methodological details, and I have seen three or four attempts at this that arrive at roughly the same place. “It would still be pretty skewed though,” is the point, Bruce, no matter the technicalities involved in defining wealth.

Your last point intrigues me: “I can live with the rich being rich and getting richer,” as long as the middle and lower classes are not losing both relatively and absolutely. Do you not see a negative correlation between the two?

Duane

LikeLike

ansonburlingame

/ March 7, 2013Henry and Bruce,

First Bruce. You and I have the same questions it seems, generally.

Henry, I readily admit that I understand very little about the dynamics of income distribution in America. But I also refuse to “sit still” and let one graph convince me that it is a disaster in the making as well. And even if the graph was absolute truth, what can and should be done about it becomes the question.

Just an example above. The author of the graph stated “wealth” was $54 Trillion yet Duane found another source stating it was $65 Trillion, in a given year. I wonder if Romney’s $250 Million stashed “somewhere” is part of that variable figure? The point of course is Romney only pays taxes on that money when it is withdrawn in a given year and “comes into America” to be used. But no taxes on the principle “stash” each year. Duane suggests that we ought to find a way to tax the principle, I suppose.

OK, how would anyone go about doing so? If I have equity in my home, should that be taxed each year as well, or my personal property equity if I had a car that was paid off? Actually that value of my home IS taxed each year to a degree thru property taxes. But I also noted my taxes on my home did not go down when the market value of the home plummeted in 2008 and onward. Did yours?

Another example. There is HUGE “wealth” in the stock market. Add up ALL the stocks listed on just the NY stock exchange and multiply each total shares of a given stock by its current price. Again a huge figure. Does anyone think we should seek a way to tax that wealth just “sitting there” each year and growing each year due to both inflation and hopefully some “real” financial growth as well?

Here is yet another example. The NYSE value is a record high right now, yet most say our economy is still struggling to recover from the GR. Why is that I wonder? It amazes me that people still buy, say Apple, at a very high price today (yet about 30% lower than its peak a couple of years ago). To me that is gambling, betting on the “come” so to speak.

I “think” the secret of American prosperity is a vibrant middle class based on history. I would love to see the curve above flattened out, for sure. But I simply have no idea how to go about doing so with government policies. However instinctively, and certainly NOT with any academic or intellectual basis, I see no way to rob Peter to pay Paul and successfully do so, on a macroscopic scale.

As for American wealth, look how it went up and down during the 1920’s, a roller coaster for sure until 1929. I wonder what the “income distribution curve” looked like in say 1928 and then in 1933, as just an example. My guess is the whole curve went down, drastically. But I wonder if the shape of the two curves changed very much. I just don’t know, but still wonder.

Consider this “magic solution”. Our “wealth” is $65 Trillion and we have 320 Million people in America. Redistribute “that” and every soul in America would be “worth” $203,000 at the “moment of magic redistribution”. How long would it remaind that way and would such redistribution be “good for America”?

It is a complex subject for sure with no obvious or simple solutions.

Anson

LikeLike

Michael D. Gaden, BSNE, MBA

/ March 11, 2013I think that the problem is not so much the current distribution of wealth (although I do see that as inequitable), but what the skewness of the curve protends for the future. It is fairly easy to see that as any given entity (person or corporation) gains wealth, then that entity has more opportunity to gain still more, assuming reasonably soiund decision-making. More wealth could assure sonund decision-making because you can pay for it, or input about it.

Is there a point where a “run-away” distribution of wealth occurs, wherein the middle class rapidly (and irreversibly) gets smaller and smaller, and the wealthy accumulate more and more? (Prompt critical, for you nukes.) If so, how close to that point are we, or are we already into it? What happens then?

And, as has been mentioned before, what can we do about it. if anything?

LikeLike